ttb analytics’ Concern over Thai Automotive Industry Currently being Faced with the Most Severe Structural Problems in 10 Years.

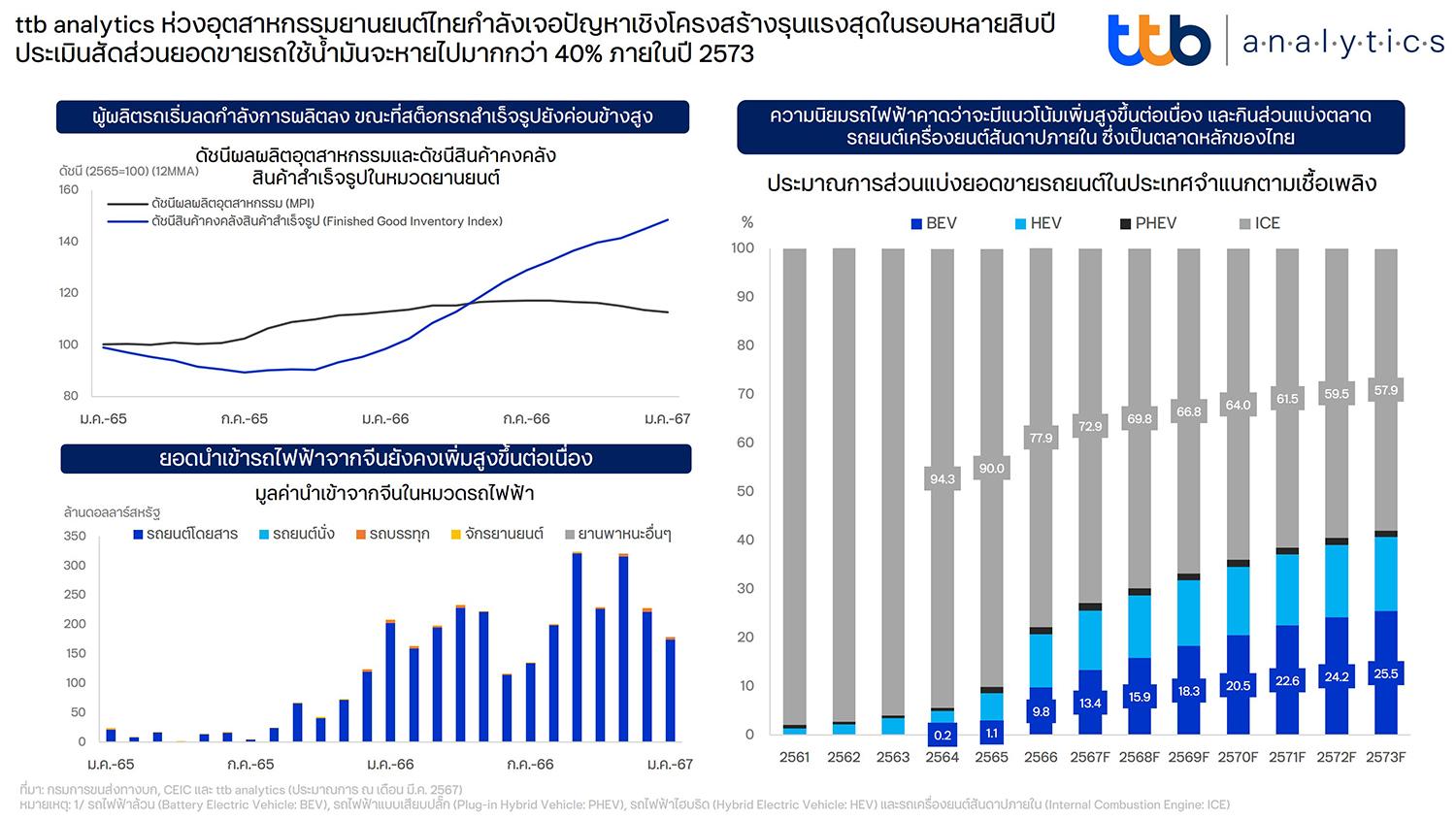

TTB Economic Analysis Center or ttb analytics views the trend on the use of Battery Electric Vehicle (BEV) in Thailand that it will continue to increase in the next period and will result in the share of Internal Combustion Engine (ICE) car sales to gradually decrease from 77.9% of total sales in 2023 to be at only 57.9% by 2030, which will eventually affect Thai automotive industry more severely because the structure of the Thai automotive manufacturing industry has been slow in the adaptation. In addition, Thailand has still been disadvantaged by the domestic automotive production costs while the goal of making Thailand a BEV production base in ASEAN may not fully be attained and competitions from neighboring countries have emerged for Thailand to be faced with. Moreover, Thailand’s role in the electric battery technology supply chain is relatively small due to the limitations in all aspects.

Domestic car sales numbers this year show a sign of continuous contraction for the second consecutive year due to many negative factors, mainly from weakening domestic purchasing power following the slow economic recovery and chronically high household debts. Business sector has still continued to delay new car purchases while waiting for clarity from government measures including the leasing guidelines of financial institutions that are still very strict. Moreover, the resale prices of used cars being decreased by more than 10%-30% compared to the average setting sale prices in the past as a result of the acceleration in bad debts in hire-purchase loans and personal loans with cars as collaterals are negative factors holding back new car sales in 2024, particularly, commercial cars which have obviously slowed down since last year.

ttb analytics estimates domestic car sales in 2024 to be at 771,780 units, or a contraction of 0.5% YoY, with the pickup truck sales expectation tended to continue shrinking, thus, resulting in this year pickup truck proportion to be stable close to that of last year at 48% of the total domestic car sales from having been used to be high of nearly 60% in 2021. Nevertheless, the BEV market will continue to grow well whereby the sales of BEV cars in 2024 are estimated to be at 103,182 units eventually making the BEV car market share being increased to 13.4% of the total car sales which is an increase of 9.8% from the previous year while the ICE car market share will drop to 72.9% of the total car sales in 2024.

However, ttb analytics is of a view that in the next period, share of the domestic sales of cares being of the ICE type will likely drop continuously from 77.9% of all domestic car sales in 2023 to only 57.9% by 2030 consequently as a result of the growth of BEV car sales in Thailand that will increase to 25.5%, in line with global market trends which indicate that the proportion of BEV car sales worldwide will increase from 13% in 2022 to reach 35%, or approximately 40 million vehicles within 2030 (estimated by International Energy Agency). These phenomena will create a stronger ripple effect to Thailand, which is the largest automotive production base in ASEAN, in the future due to the reason that Thailand has a limitation in making structural changes. Any rate, the Thai automotive industry in the overall picture, has still been in a state of stagnation since 2023 following the trend of the domestic market slowing down.

Although, the trend on the use of electric vehicle in Thailand is growing rapidly, but, Japanese automakers having Thailand as their main production bases have still been slow in making the adaptation from the plans for productions and marketing of BEVs of Japanese manufacturers which are still somewhat quite lesser than those of Chinese, American or even European manufacturers eventually making Thailand which is just only an OEM of the Japanese manufacturers still focusing on the productions of ICE cars and Hybrid Electric Vehicles (HEVs) that are fragile groups and severely affected by the risk of being replaced by technology if they are unable to adapt to the needs of the global market, particularly, car manufacturers focusing on marketing cars with ICE, including parts and components industry, whether being in the group of powertrain parts or engine which is about to be completely replaced by an electric motor system. This phenomenon will affect both Tier 1 manufacturers, distributors and service centers as well as Tier 2 and Tier 3 manufacturers which mostly are small and medium-sized Thai entrepreneurs with low labor productivity and fragile financial status.

It will be more difficult for Thai car manufacture to achieve the economies of scale in the long run. Currently, Thailand manufactures an average of 2 million cars per year, which 91.4% of the total car manufacture (passenger cars and pickup trucks) are ICE cars followed by 8.6% being the manufacture of Hybrid Electric Vehicles (HEVs) and Plug-in Hybrid Electric Vehicles (PHEVs) and the remaining 0.01% the manufacture of BEVs. Although, in the near future, it will not have much impact on the entire automotive industry because 60% is the manufacture of the pickup trucks that almost all of which are of ICE type. But it is expected that in the next 2-3 years, major manufacturers will accelerate the development of BEV pickup trucks to a level suitable for commercial use which will eventually cause the demands for both ICE passenger cars and pickup trucks to tend to decrease worldwide.

Thailand’s role in the battery production supply chain for electric vehicles is relatively small because Thailand has not yet had a production source for lithium and nickel which is an important component for the production of electric vehicle batteries at the upstream level. So, we are at a disadvantageous position to neighboring countries like Indonesia that has 30% of the world’s nickel ore resources. In addition, Indonesian labor costs are still cheaper than Thailand. All these factors have become the important constraints that will cause Thailand to probably lose more share of the electric vehicle industry to surrounding countries in the future. Moreover, Chinese manufacturers are starting to turn to setting up their own factories to produce electric battery parts to meet the requirements for using the local content, thus, causing the development and transfer of production technology from foreign companies to be somewhat rather limited while research and development in producing batteries for electric vehicles from domestic manufacturers have still been in the starting period and the production capacity has still been at a small scale.